does georgia have estate or inheritance tax

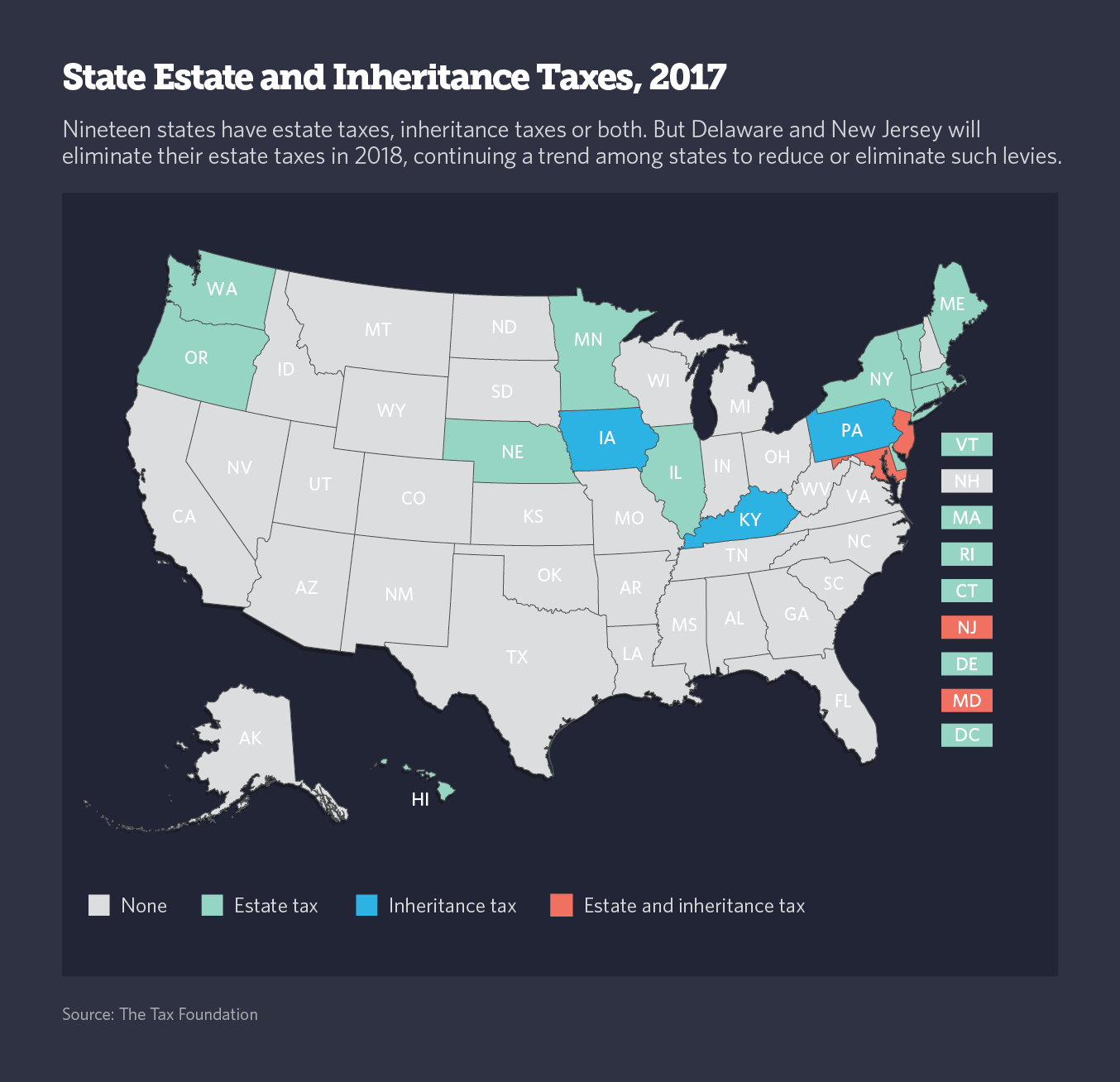

Web In addition to the federal estate tax with a top rate of 40 percent some states levy an additional state estate tax or state inheritance tax. Due to the high limit many estates are exempt from estate taxes.

Wisconsin Losing Ground To Tax Friendly Peers Tax Foundation

Web Does Georgia have an estate or inheritance tax.

. Web Georgians are only accountable for federally-mandated estate taxes. The tax is paid by the estate. Inheritance taxes also known as estate taxes are the taxes paid on the property left to the heirs of a deceased person.

Estate taxes are only mandated in a. Web Georgia does not have any inheritance tax or estate tax for 2012. Before assuming that an estate is exempt it is critically important to.

Web No Georgia does not have an estate tax or an inheritance tax on its inheritance laws. The executor will also pay the creditors as their claims are received. Web According to the Georgia Department of Revenue state legislature enacted the law that eliminated estate taxes on July 1 st 2014.

However this privilege only. Twelve states and the District. Suppose the deceased georgia resident left their heir a 13 million worth of an estate.

Web In the Tax Cuts and Jobs Act of 2017 the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires. The estate tax is paid by the estate whereas the inheritance tax is levied on. Georgia does not have an inheritance tax.

Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. The default inheritance rule. Web Georgia law is similar to federal law.

Web The state with the highest maximum estate tax rate is Washington 20 percent followed by eleven states which have a maximum rate of 16 percent. This means that if you pass away in the state of Georgia your beneficiaries will not have to pay any tax on. Web The good news is that georgia does not have an inheritance tax.

Web Inheritance taxes also known as estate taxes are the taxes paid on the property left to the heirs of a deceased person. Web These states have an inheritance tax. Web Those are the inheritance tax and the estate tax.

Web Georgia does not assess and inheritance tax or a gift tax. They are also sometimes referred to as Death Taxes as they apply to the property of the recently deceased before and after it. Web A 1 million estate in a state with a 500000 exemption would be taxed on 500000.

There is the federal estate tax to worry about potentially but the federal estate tax threshhold is.

Estate Planning 101 Your Guide To Estate Tax In Georgia

Georgia Estate Tax Everything You Need To Know Smartasset

Here S Another Reason To Put Georgia On Your Retirement List

State By State Comparison Where Should You Retire

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Gov Charlie Baker Optimistic About Nearly 700 Million In Tax Break Proposals Including Changes To Massachusetts Estate Tax Masslive Com

Georgia Retirement Tax Friendliness Smartasset

4 Reasons Why Estate Planning Is Important Goldberg Associates

Does A Will Have To Be Probated In Georgia Estate Planning Lawyer John P Farrell 678 809 4922

Here Are The States With No Estate Or Inheritance Taxes

Georgia Inheritance Laws What You Should Know Smartasset

Georgia Inheritance Laws What You Should Know Smartasset

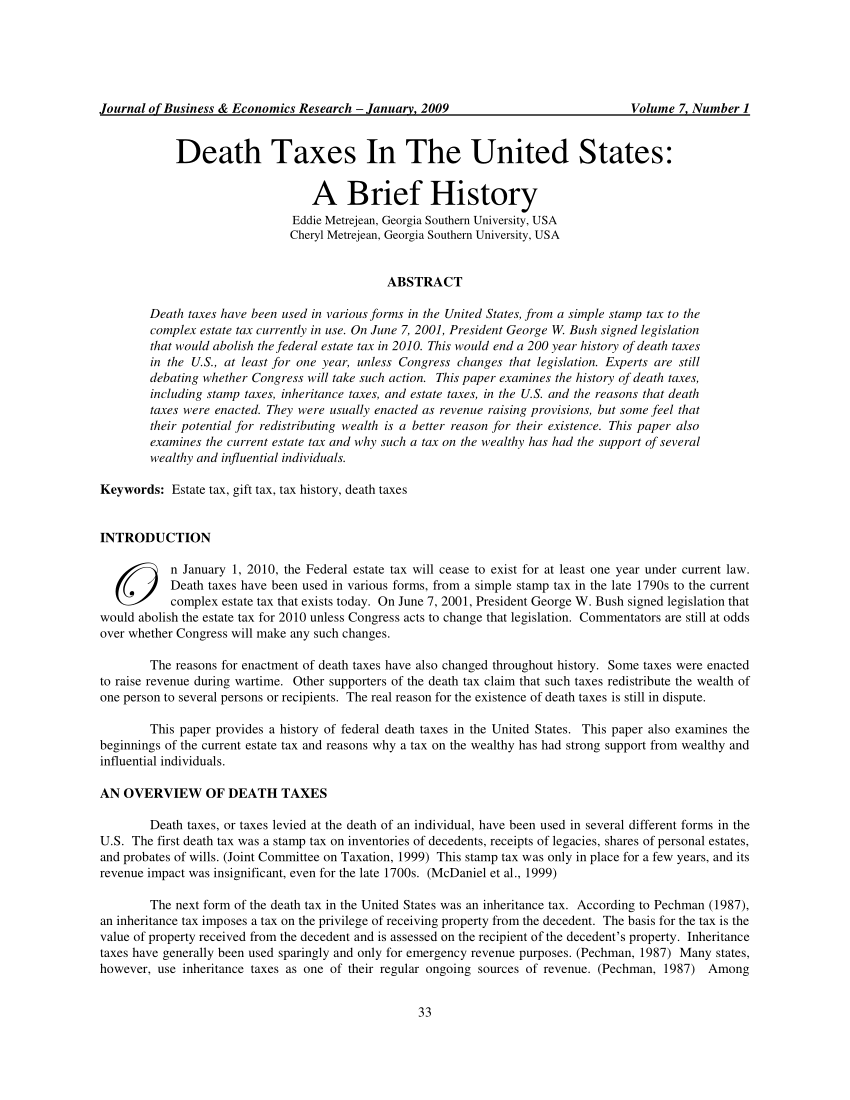

Pdf Death Taxes In The United States A Brief History

State Death Tax Hikes Loom Where Not To Die In 2021

Georgia Estate Law Faulkner Law

Taxation In Georgia No More Tax

What Happens During The Georgia Probate Process Breyer Home Buyers

Where Not To Die In 2022 The Greediest Death Tax States

In States The Estate Tax Nears Extinction The Pew Charitable Trusts